As profit margins return to historical levels, auto dealers are looking for ways to generate additional earnings. Dealer finance and insurance (F&I) profit participation programs are often overlooked in the quest to boost profits — an expensive oversight. These established strategies can provide dealers with solid cash flows and investment returns.

While many dealerships already have profit-sharing programs in place, these programs often fall short of a dealer’s goals. And dealers can miss their full profit potential if warranty programs aren’t aligned with their business and personal wealth goals — or if they aren’t optimally executed.

F&I profit participation programs can support a dealership in:

- Generating cash flow.

- Funding acquisitions.

- Managing tax strategies.

To varying degrees, the programs can be used to:

- Provide incentives and rewards to key management.

- Establish a vehicle for wealth building and estate planning.

- Support multi-generational succession and business transition.

The Range of F&I Profit Participation Programs

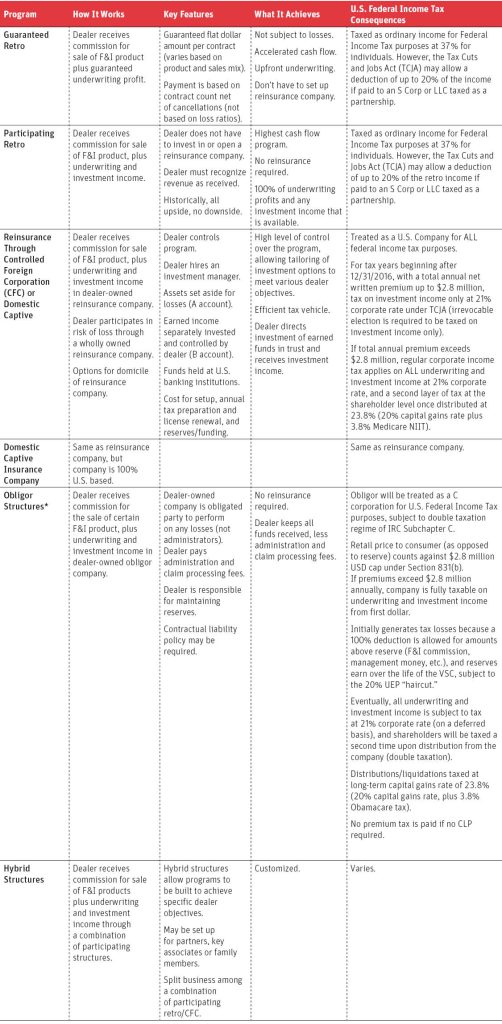

F&I profit programs vary greatly in structure, economics, flexibility, risk and tax consequences. To find the best fit for your situation, you’ll want to understand each type and its ability to deliver what your business, transition plan and personal wealth strategy demand.

A Strong Advisory Team Can Craft a Plan That Best Fits Your Goals

Determining the right F&I approach requires having the right advisory team in place. Anchor your search with a strong team of specialized experts who can help you hone in on your specific objectives and identify a profit participation program that best meets those goals. Your team should include trusted individuals who bring insights and informed perspectives from many angles, including:

- An F&I program provider who can bring numerous options to the table and is prepared to tailor a formula to your needs.

- A tax advisor with a keen understanding of the tax code — current laws, in addition to clear projections for how future tax updates — including the sunset of provisions of the TJCA that may impact the direction you take.

- A CPA who fully grasps how your strategy affects your business finances and impacts dealership valuation.

- An attorney who has the experience to advise you on how to structure your program legally for maximum effect and resilience.

- A banking advisor who can set up appropriate accounts and structure trusts for your plan.

Flexibility is Key To Implementing an Effective Long-Term Strategy

Change is a constant for your business. From evolving tax laws and fluctuating business cycles to market swings and macroeconomic ebbs and flows, external forces that affect your dealership are constantly shifting the playing field. Your goals and plans change over time as well, so your profit participation program shouldn’t be set in stone.

Make ongoing conversations about your current F&I plan a priority — the effectiveness of your strategy can diminish if it remains static. It’s essential for dealers to work with a program provider that brings multiple options and a proactive mindset — a partner who’s prepared to adapt your approach to address your changing needs.

Your advisory team should meet regularly to assess the status of your plan (quarterly or semi-annually is ideal). That includes discussing any changes to your objectives and examining any shifts in the broader business landscape or economic environment that might impact your dealership.

Your strategy can provide meaningful earnings to support overall dealership profits or help meet your targets. Depending on your course of action, F&I profit participation can impact the timing of your business cash flow. As part of your planning, F&I and reinsurance can be invaluable tools that expand your options for dealership transition and succession planning.

Special thanks to Matt Joffe, managing shareholder for Total Warranty Services (TWS). TWS specializes in creating customized F&I programs including vehicle service contracts, as well as all ancillary protection products. The TWS participation team can provide a customized underwriting participation program to fit each client’s unique goals. TWS has worked with over 1,600 auto dealerships and is one of the nation’s top 10 largest F&I product providers with over $1.5 billion in written premium and over seven million contracts sold. To find out more about how TWS can help your dealership, contact Matt Joffe at mjoffe@totalwarrantyservices.com.

Truist Bank, Member FDIC. ©2024 Truist Financial Corporation. Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation. Equal Housing Lender.